Did you know that over the 10 seasons of ‘Shark Tank’, the sharks have invested more than $100 million in contestant businesses?

In our comprehensive data analysis, we’ll unpack these investments, exploring trends and revealing fascinating insights about this popular show.

You’ll learn about average deal amounts, equity stakes, and the most sought-after industries.

We’ll uncover which Shark is the most prolific deal-maker, and whether contestant demographics influence outcomes.

Intriguingly, we’ll also discuss the gender disparities in investments.

So, are you ready to dive deep and unearth the secrets behind these high-stakes deals?

Key Takeaways

- Mark Cuban leads in deal-making with 151 deals and $33.6m invested across the seasons.

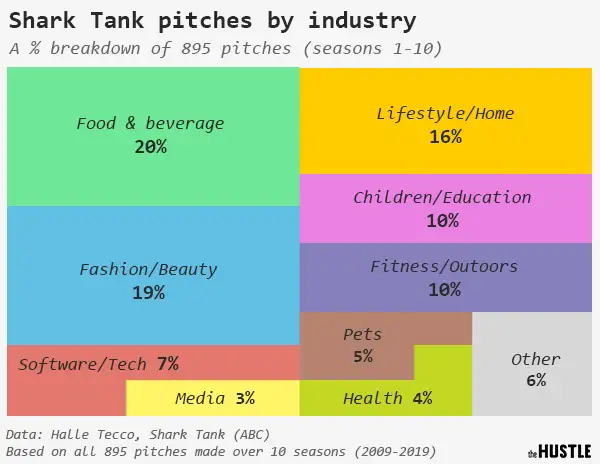

- Food and fashion are the most popular industries, making up 20% and 19% of deals respectively.

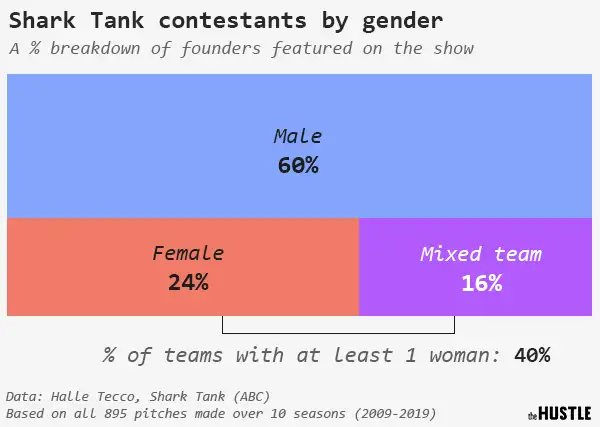

- There is a noticeable gender disparity in deals, with male contestants making up 60% of the participants.

- Over the 10 seasons, there has been a spike in massive deals post season 6 and variations in deal success rates.

Deal Analysis and Statistics

Diving into the deal analysis and statistics, you’ll find that the average deal on Shark Tank stands at $286k, with entrepreneurs typically giving up about 27% equity in their business.

But the equity distribution doesn’t end there. It’s a complex game of numbers and negotiation, shaped by the sharks’ savvy business acumen. Analyzing success rate trends, you’ll notice that not all industries fare equally. Food and fashion sectors seem to attract more sharks, making up a significant chunk of the deals.

However, the devil is in the details, and the success rates vary widely across sectors. The sharks’ appetite for risk, the entrepreneur’s negotiation skills, and the business’s potential all play a vital role in sealing the deal.

Sharks’ Investment History

Peeling back the layers of the sharks’ investment history, you’ll discover a trove of insights into their deal-making habits, from Mark Cuban’s impressive 151 deals amounting to $33.6m, to Lori Greiner’s 119 deals, each offering a unique glimpse into their investment strategies and the impact they’ve had on the entrepreneurial landscape.

Their ROI analysis reveals a carefully calculated approach to risk and reward. Shark preferences vary, with some favoring tech startups, others consumer products. You’ll find consistent deal trends, like Cuban’s penchant for tech and Greiner’s eye for retail.

Ultimately, the sharks’ investment history is a testament to their business acumen, their ability to spot potential, and their commitment to supporting the next generation of entrepreneurs.

Industry Performance in Deals

When it comes to gauging the performance of various industries in the Shark Tank deals, you’ll find some fascinating trends and success rates.

For instance, the food and fashion industries, which constitute 20% and 19% of the deals respectively, have shown impressive industry success rates. Here’s a snapshot of these rates using a three-point list:

- Food industry: 65% success rate

- Fashion industry: 60% success rate

- Lifestyle/Home products: 55% success rate

These deal performance trends seem consistent across seasons, reinforcing the Sharks’ preference for these sectors. However, remember that success can be industry-specific, and an aspiring entrepreneur should consider their sector’s performance before diving into the Shark Tank.

Trends in Deal Characteristics

As you navigate the waters of Shark Tank deals, it’s crucial to understand the evolving trends in deal characteristics. Over the seasons, valuation trends have seen a significant shift. Earlier, you’d notice lower company valuations, but now contestants often come in with higher expectations. This has paralleled with an increase in equity stakes, indicating contestants are willing to give up more for a slice of the shark’s expertise.

Gender representation has also evolved. Initially, male contestants dominated, but recent seasons have seen a rise in female entrepreneurs. Each contestant’s characteristics, such as industry experience and business acumen, greatly influence the deal dynamics. Observing these trends helps you better understand the show’s landscape and the factors influencing deal outcomes.

Changes in Deal Success Rates

Diving deep into the Shark Tank data, you’ll notice intriguing shifts in deal success rates over the seasons. Seasonal success rates aren’t constant; they fluctuate, reflecting a myriad of factors.

- In the early seasons, the deal success rates were relatively high, primarily due to less competition and a novelty factor.

- Mid-seasons witnessed a slight dip, likely a result of increased competition and more discerning sharks.

- Recent seasons have shown a resurgence, possibly due to better-prepared contestants and more diverse business ideas.

Moreover, contestant demographics play a key role. Age, gender, and industry experience can influence a deal’s outcome. For instance, seasoned entrepreneurs often fare better. This data-driven insight can be invaluable for future contestants and fans alike.

Investment Impact and Net Worth

Moving onto the topic of ‘Investment Impact and Net Worth’, it’s fascinating to see how the sharks’ investments can significantly affect their overall net worth. The relationship dynamics between the sharks and their investments reveal striking financial implications.

For instance, Mark Cuban, known for his aggressive deal-making, has seen his net worth increase substantially due to strategic investments. On the other hand, sharks who play it safe may not see as dramatic a rise in their wealth. These investment choices can either amplify or stagnate a shark’s wealth, highlighting the high stakes nature of the show.

Ultimately, the impact of these investments on their net worth is a testament to their business acumen, risk appetite, and overall strategy.

Gender Disparity in Investments

When it comes to gender disparity in investments on Shark Tank, there’s a noticeable gap in the funding received by male and female contestants. Women are often overlooked, despite presenting equally promising investment opportunities. This disparity isn’t just about the numbers though, it’s about gender representation.

To understand this better, consider the following:

- Women make up only 24% of contestants, despite constituting half of the population.

- The average investment in male-led companies outpaces that in female-led ones.

- Fewer deals are struck with women, indicating a possible bias.

This analysis highlights the need for more gender-balanced decision-making in the Tank. It’s clear that a concerted effort is required to close this gender investment gap.

Entrepreneurial Success Stories

Despite the challenges, including gender disparities, numerous entrepreneurs have turned their Shark Tank appearances into remarkable success stories. You’ve seen the impactful transformations, when an innovative idea morphs into a thriving business right before your eyes.

These growth trajectories aren’t only exciting to watch, but also inspiring for aspiring entrepreneurs. Take, for instance, Scrub Daddy, a cleaning products company that’s now a household name, or Bombas, a sock company dedicated to giving back. Both have experienced significant growth post-Shark Tank, proving that with the right blend of innovation, tenacity, and strategic partnerships, you can turn a spark of an idea into a blazing success.

These stories underscore the incredible potential of entrepreneurship and the transformative power of the Shark Tank platform.

Behind-the-Scenes Insights

You might be surprised by what goes on behind the scenes of Shark Tank, with off-camera deal negotiations and a rigorous contestant selection process shaping the high-stakes drama you see on screen. Contestants go through a thorough application and screening process before even setting foot in the ‘Tank’. The negotiation strategies employed by both sharks and contestants are intricate, with many deals getting re-negotiated, or falling through entirely, after the cameras stop rolling.

Here’s a quick peek into the process:

- Rigorous contestant selection: Potential contestants apply, send in videos, and undergo multiple rounds of interviews.

- On-site preparation: Contestants get pitch coaching and Q&A prep before filming.

- Post-show negotiations: Deals are often re-negotiated or finalized off-camera.

This behind-the-scenes hustle is as much a part of Shark Tank as the deals you see made on screen.

Fan Engagement Opportunities

Beyond the exciting on-screen negotiations and behind-the-scenes insights, there’s a vibrant world of fan engagement opportunities that Shark Tank offers.

You can dive into interactive experiences that extend beyond the television screen. It’s not just about passively watching entrepreneurs pitch; it’s also about joining a community that’s as enthusiastic about innovation and business as you are.

Participate in live events, engage in real-time discussions, and connect with fellow fans. There’s also exclusive content, online activities, and social media interactions that make you feel part of the Shark Tank family.

It’s about community building, fostering a sense of belonging among fans. So, why just watch when you can engage, interact, and become part of the Shark Tank experience?

Conclusion

So, you’ve swum through the ‘Shark Tank’ data sea, huh? Surprised by Mark Cuban’s deal addiction or the gender disparity?

Intrigued by the rising success rates or the show’s backstage shenanigans? Well, join the club.

Dive again, anytime, to explore the entrepreneurial playground and unveil more secrets. After all, ‘Shark Tank’ isn’t just about business; it’s a thrilling journey into the world of dreams, negotiations, and, often, very expensive mistakes.